BOX-COX 람다추정 하는법

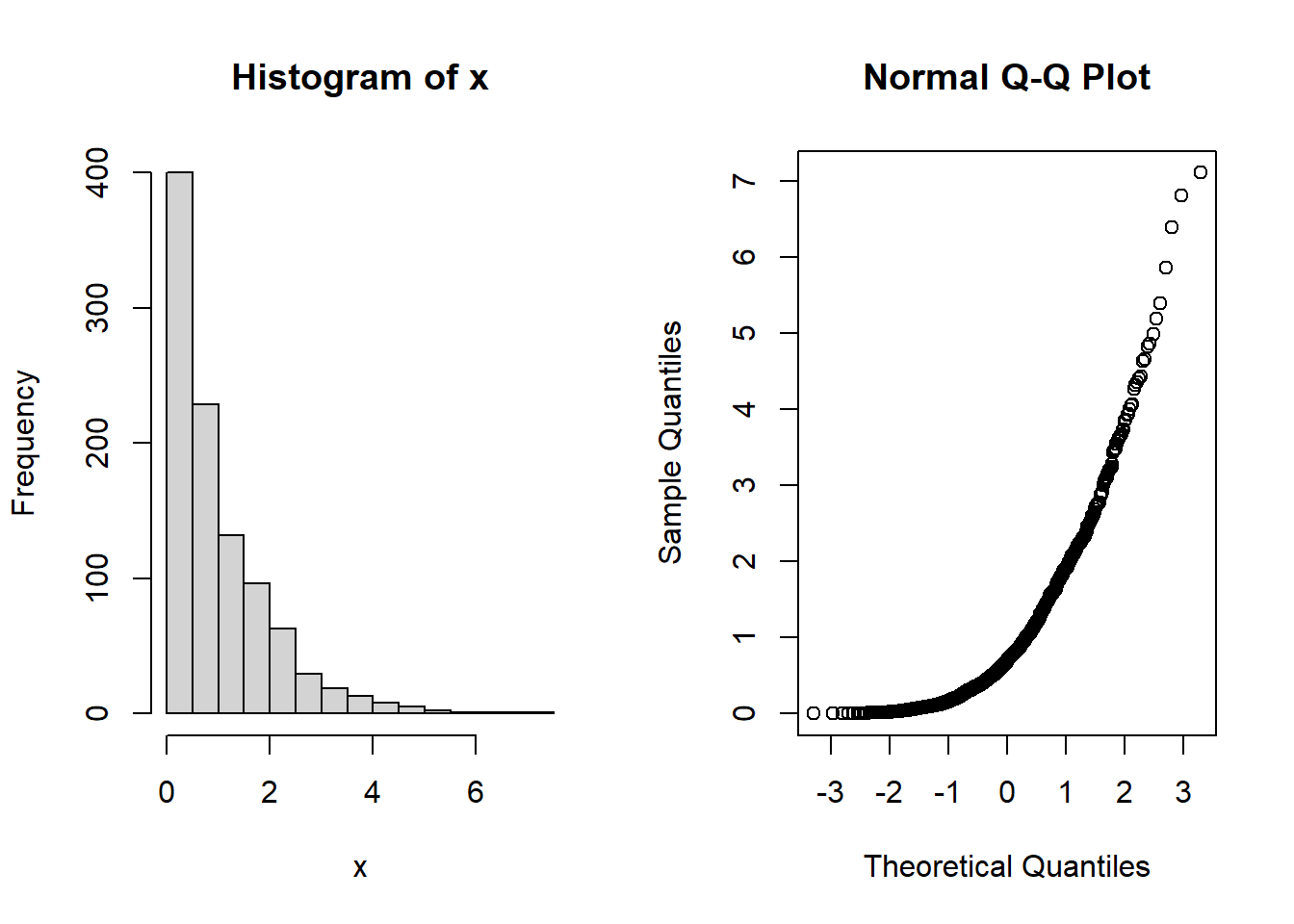

x <- rexp(1000) # 지수분포로부터 난수를 발생시킨다.

par(mfrow=c(1,2))

hist(x)

qqnorm(x) # 정규확률그림 생성

par(mfrow=c(1,1))

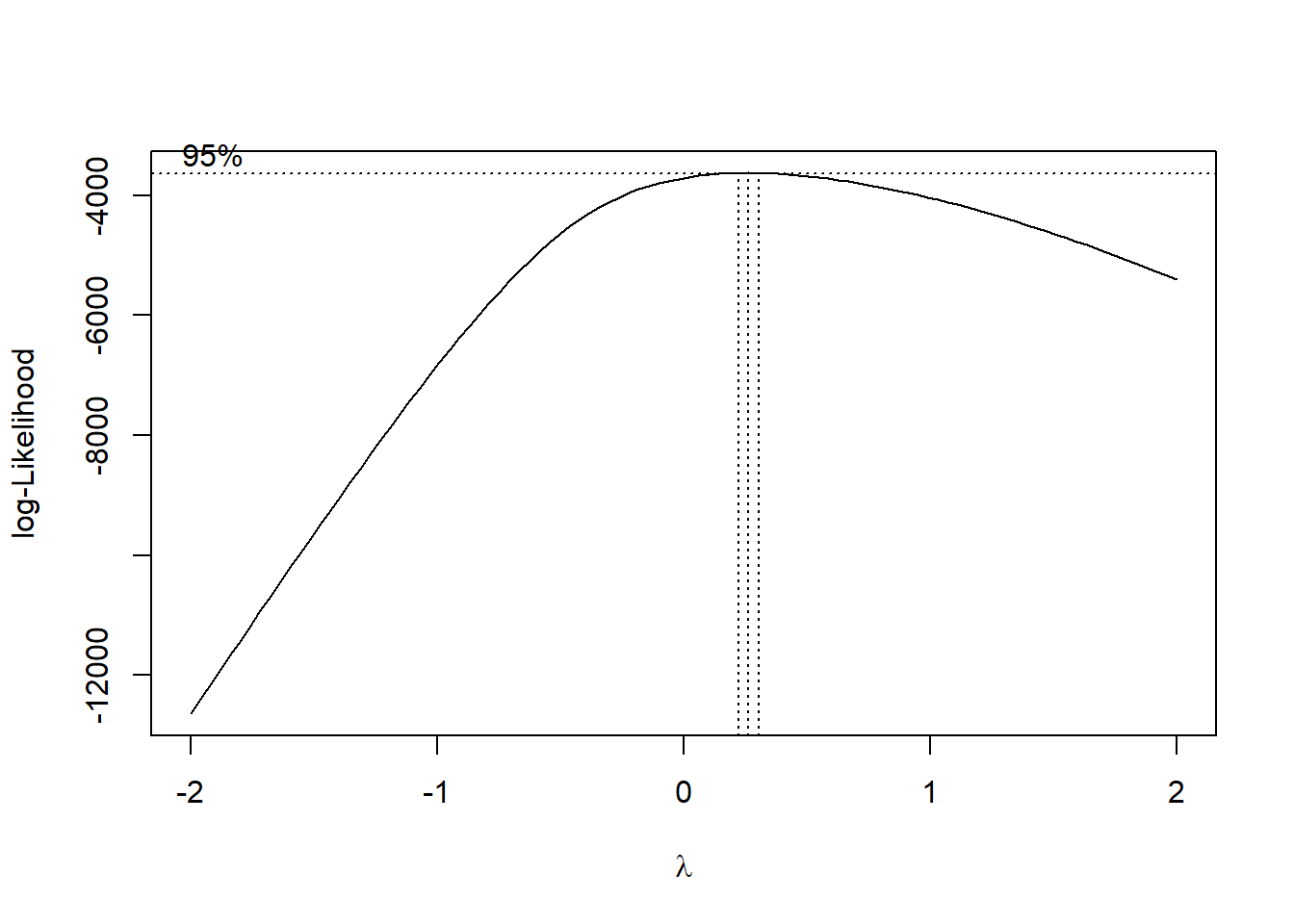

boxcox(x~1) # 로그-가능도 프로파일 생성

p <- powerTransform(x) # 박스-콕스 변환의 람다 추정

p## Estimated transformation parameter

## x

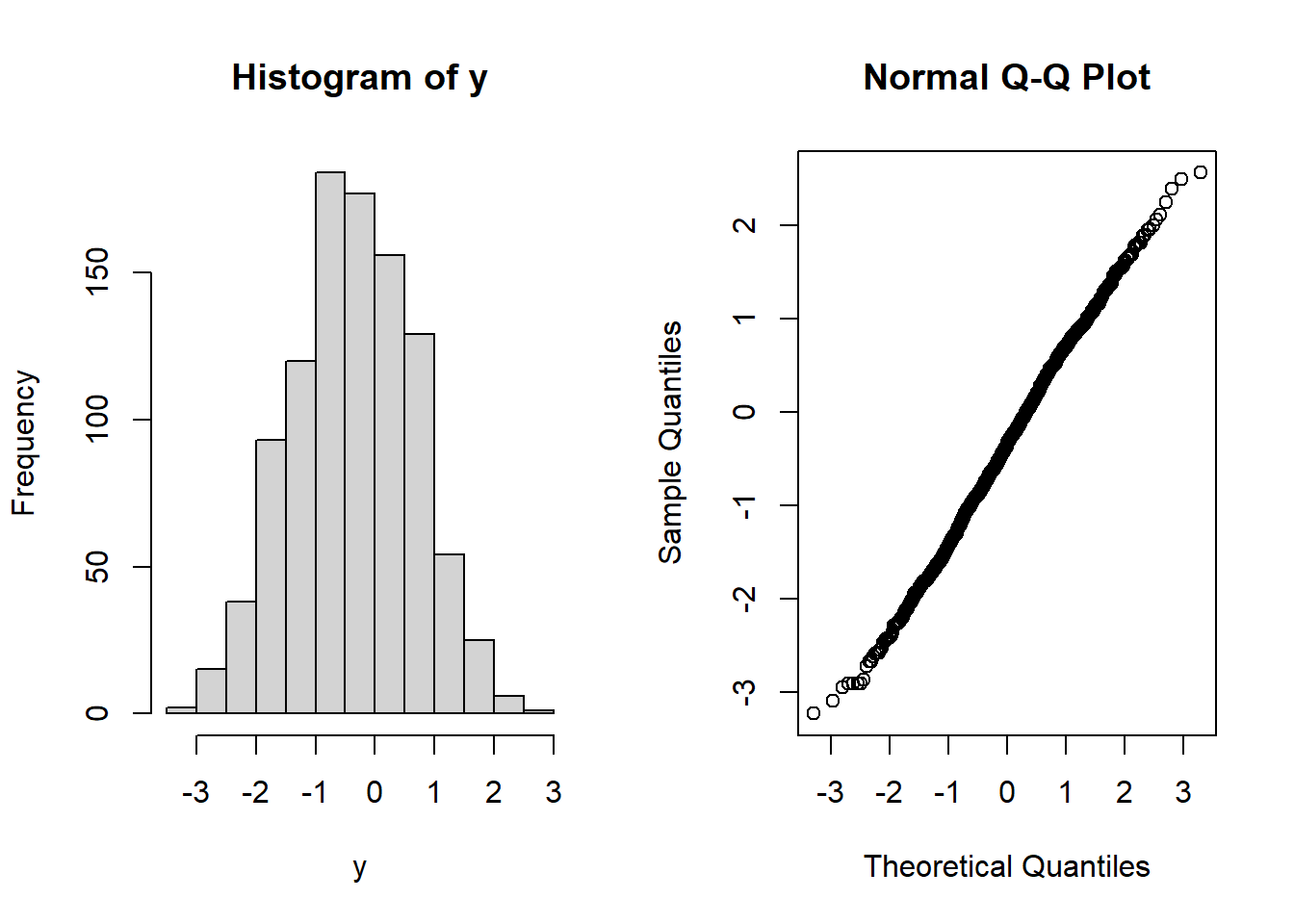

## 0.2631179 y <- bcPower(x, p$lambda) # 박스-콕스 변환

par(mfrow=c(1,2))

hist(y)

qqnorm(y) # 변환된 자료의 정규확률그림 생성

VAR모형분석

샘플을 생성한다

set.seed(111)

t <- 200 # Number of time series observations

k <- 2 # Number of endogenous variables

p <- 2 # Number of lags상관계수 행렬 생성

A.1 <- matrix(c(-.3, .6, -.4, .5), k) # Coefficient matrix of lag 1

A.2 <- matrix(c(-.1, -.2, .1, .05), k) # Coefficient matrix of lag 2

A <- cbind(A.1, A.2) # Companion form of the coefficient matrices예제 2

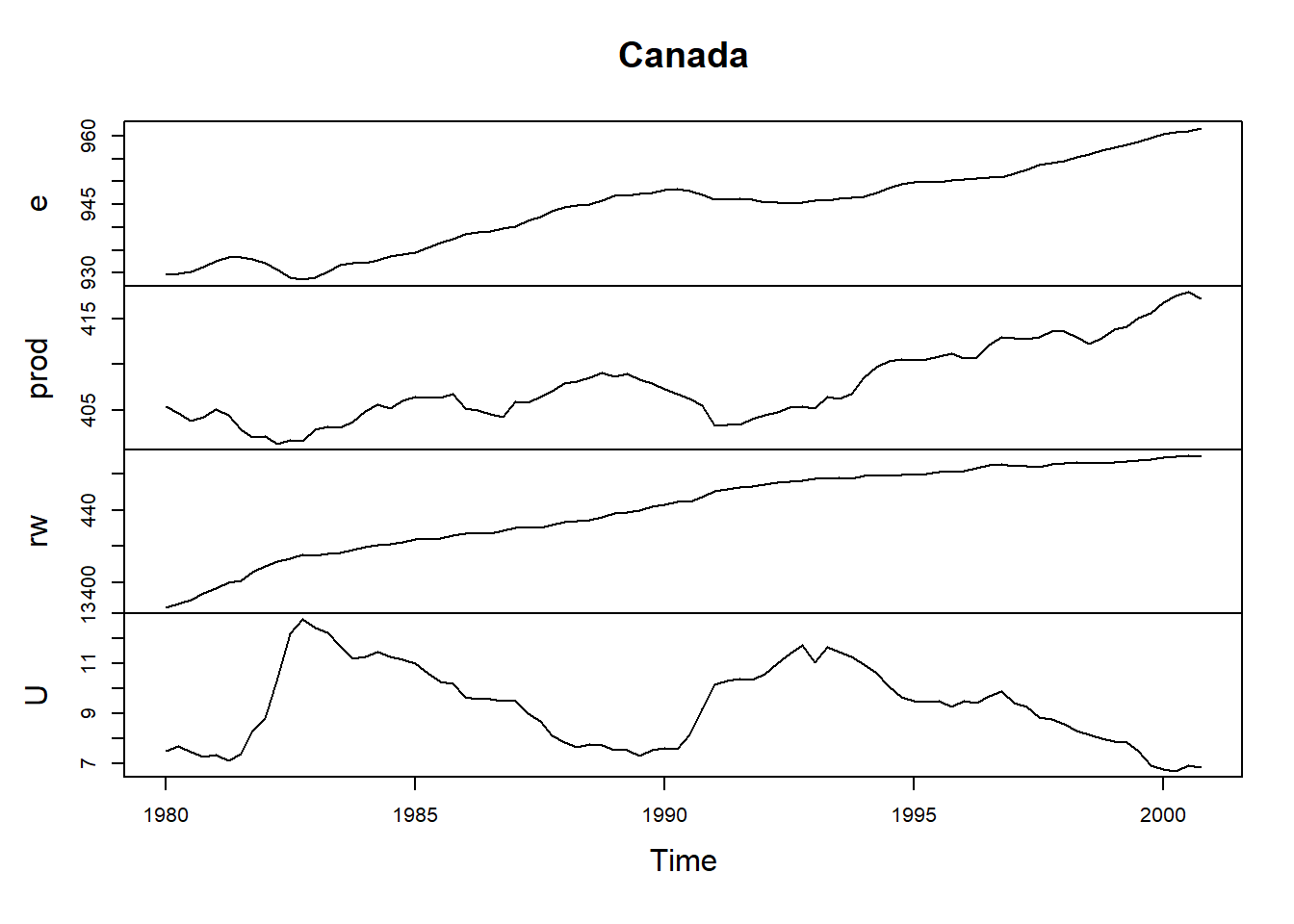

data(Canada)

summary(Canada)## e prod rw U

## Min. :928.6 Min. :401.3 Min. :386.1 Min. : 6.700

## 1st Qu.:935.4 1st Qu.:404.8 1st Qu.:423.9 1st Qu.: 7.782

## Median :946.0 Median :406.5 Median :444.4 Median : 9.450

## Mean :944.3 Mean :407.8 Mean :440.8 Mean : 9.321

## 3rd Qu.:950.0 3rd Qu.:410.7 3rd Qu.:461.1 3rd Qu.:10.607

## Max. :961.8 Max. :418.0 Max. :470.0 Max. :12.770시도표

plot.ts(Canada)  ## 단위근검정시행

## 단위근검정시행

adf1 <- summary(ur.df(Canada[, "prod"], type = "trend", lags = 2)) #비정상추세있음

adf1 ##

## ###############################################

## # Augmented Dickey-Fuller Test Unit Root Test #

## ###############################################

##

## Test regression trend

##

##

## Call:

## lm(formula = z.diff ~ z.lag.1 + 1 + tt + z.diff.lag)

##

## Residuals:

## Min 1Q Median 3Q Max

## -2.19924 -0.38994 0.04294 0.41914 1.71660

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 30.415228 15.309403 1.987 0.0506 .

## z.lag.1 -0.075791 0.038134 -1.988 0.0505 .

## tt 0.013896 0.006422 2.164 0.0336 *

## z.diff.lag1 0.284866 0.114359 2.491 0.0149 *

## z.diff.lag2 0.080019 0.116090 0.689 0.4927

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.6851 on 76 degrees of freedom

## Multiple R-squared: 0.1354, Adjusted R-squared: 0.08993

## F-statistic: 2.976 on 4 and 76 DF, p-value: 0.02438

##

##

## Value of test-statistic is: -1.9875 2.3 2.3817

##

## Critical values for test statistics:

## 1pct 5pct 10pct

## tau3 -4.04 -3.45 -3.15

## phi2 6.50 4.88 4.16

## phi3 8.73 6.49 5.47변수들이 차분 1이 필요

VARselect(Canada, lag.max = 8, type = "both") #시차 2가 가장 큰작은 값을 가짐 ## $selection

## AIC(n) HQ(n) SC(n) FPE(n)

## 3 2 1 3

##

## $criteria

## 1 2 3 4 5

## AIC(n) -6.272579064 -6.636669705 -6.771176872 -6.634609210 -6.398132246

## HQ(n) -5.978429449 -6.146420347 -6.084827770 -5.752160366 -5.319583658

## SC(n) -5.536558009 -5.409967947 -5.053794411 -4.426546046 -3.699388378

## FPE(n) 0.001889842 0.001319462 0.001166019 0.001363175 0.001782055

## 6 7 8

## AIC(n) -6.307704843 -6.070727259 -6.06159685

## HQ(n) -5.033056512 -4.599979185 -4.39474903

## SC(n) -3.118280272 -2.390621985 -1.89081087

## FPE(n) 0.002044202 0.002768551 0.00306012결과를 보면 각자 다른 차수를 추천

$selection

AIC(n) HQ(n) SC(n) FPE(n)

3 2 1 3 sc가 추천해준 시차 1

Canada <- Canada[, c("prod", "e", "U", "rw")]

p1ct <- VAR(Canada, p = 1, type = "both")

p1ct##

## VAR Estimation Results:

## =======================

##

## Estimated coefficients for equation prod:

## =========================================

## Call:

## prod = prod.l1 + e.l1 + U.l1 + rw.l1 + const + trend

##

## prod.l1 e.l1 U.l1 rw.l1 const trend

## 0.96313671 0.01291155 0.21108918 -0.03909399 16.24340747 0.04613085

##

##

## Estimated coefficients for equation e:

## ======================================

## Call:

## e = prod.l1 + e.l1 + U.l1 + rw.l1 + const + trend

##

## prod.l1 e.l1 U.l1 rw.l1 const

## 0.19465028 1.23892283 0.62301475 -0.06776277 -278.76121138

## trend

## -0.04066045

##

##

## Estimated coefficients for equation U:

## ======================================

## Call:

## U = prod.l1 + e.l1 + U.l1 + rw.l1 + const + trend

##

## prod.l1 e.l1 U.l1 rw.l1 const trend

## -0.12319201 -0.24844234 0.39158002 0.06580819 259.98200967 0.03451663

##

##

## Estimated coefficients for equation rw:

## =======================================

## Call:

## rw = prod.l1 + e.l1 + U.l1 + rw.l1 + const + trend

##

## prod.l1 e.l1 U.l1 rw.l1 const trend

## -0.22308744 -0.05104397 -0.36863956 0.94890946 163.02453066 0.07142229summary(p1ct, equation = "e") #e 시계열만 보여줌##

## VAR Estimation Results:

## =========================

## Endogenous variables: prod, e, U, rw

## Deterministic variables: both

## Sample size: 83

## Log Likelihood: -207.525

## Roots of the characteristic polynomial:

## 0.9504 0.9504 0.9045 0.7513

## Call:

## VAR(y = Canada, p = 1, type = "both")

##

##

## Estimation results for equation e:

## ==================================

## e = prod.l1 + e.l1 + U.l1 + rw.l1 + const + trend

##

## Estimate Std. Error t value Pr(>|t|)

## prod.l1 0.19465 0.03612 5.389 7.49e-07 ***

## e.l1 1.23892 0.08632 14.353 < 2e-16 ***

## U.l1 0.62301 0.16927 3.681 0.000430 ***

## rw.l1 -0.06776 0.02828 -2.396 0.018991 *

## const -278.76121 75.18295 -3.708 0.000392 ***

## trend -0.04066 0.01970 -2.064 0.042378 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

##

## Residual standard error: 0.4701 on 77 degrees of freedom

## Multiple R-Squared: 0.9975, Adjusted R-squared: 0.9973

## F-statistic: 6088 on 5 and 77 DF, p-value: < 2.2e-16

##

##

##

## Covariance matrix of residuals:

## prod e U rw

## prod 0.469517 0.06767 -0.04128 0.002141

## e 0.067667 0.22096 -0.13200 -0.082793

## U -0.041280 -0.13200 0.12161 0.063738

## rw 0.002141 -0.08279 0.06374 0.593174

##

## Correlation matrix of residuals:

## prod e U rw

## prod 1.000000 0.2101 -0.1728 0.004057

## e 0.210085 1.0000 -0.8052 -0.228688

## U -0.172753 -0.8052 1.0000 0.237307

## rw 0.004057 -0.2287 0.2373 1.000000ser11 <- serial.test(p1ct, lags.pt = 16, type = "PT.asymptotic") #포트만토검정

ser11$serial##

## Portmanteau Test (asymptotic)

##

## data: Residuals of VAR object p1ct

## Chi-squared = 233.5, df = 240, p-value = 0.606var.2c <- VAR(Canada, p = 2, type = "const")

predict(var.2c, n.ahead = 8, ci = 0.95)## $prod

## fcst lower upper CI

## [1,] 417.2623 415.9835 418.5411 1.278808

## [2,] 417.7410 415.7854 419.6965 1.955532

## [3,] 418.2196 415.7674 420.6717 2.452134

## [4,] 418.5639 415.6897 421.4380 2.874136

## [5,] 418.7644 415.5065 422.0224 3.257935

## [6,] 418.8374 415.2253 422.4494 3.612043

## [7,] 418.8097 414.8748 422.7446 3.934890

## [8,] 418.7110 414.4881 422.9340 4.222973

##

## $e

## fcst lower upper CI

## [1,] 962.6557 961.9446 963.3668 0.7111044

## [2,] 963.6538 962.3422 964.9654 1.3116050

## [3,] 964.6932 962.8261 966.5603 1.8670903

## [4,] 965.6882 963.3092 968.0671 2.3789396

## [5,] 966.5814 963.7240 969.4387 2.8573301

## [6,] 967.3460 964.0344 970.6576 3.3116112

## [7,] 967.9769 964.2302 971.7236 3.7467269

## [8,] 968.4827 964.3193 972.6461 4.1633974

##

## $U

## fcst lower upper CI

## [1,] 6.428832 5.880708 6.976957 0.5481244

## [2,] 5.903919 5.017510 6.790327 0.8864083

## [3,] 5.396177 4.219319 6.573035 1.1768580

## [4,] 4.949219 3.518061 6.380377 1.4311576

## [5,] 4.595008 2.932516 6.257500 1.6624923

## [6,] 4.343933 2.463420 6.224445 1.8805126

## [7,] 4.191928 2.102592 6.281265 2.0893366

## [8,] 4.126745 1.837864 6.415625 2.2888805

##

## $rw

## fcst lower upper CI

## [1,] 470.2954 468.7660 471.8247 1.529348

## [2,] 470.8948 468.8195 472.9701 2.075289

## [3,] 471.5360 469.0592 474.0128 2.476757

## [4,] 472.2490 469.4525 475.0456 2.796577

## [5,] 473.0652 469.9976 476.1329 3.067654

## [6,] 473.9943 470.6851 477.3035 3.309184

## [7,] 475.0275 471.4966 478.5584 3.530898

## [8,] 476.1454 472.4082 479.8825 3.737164