기초단계

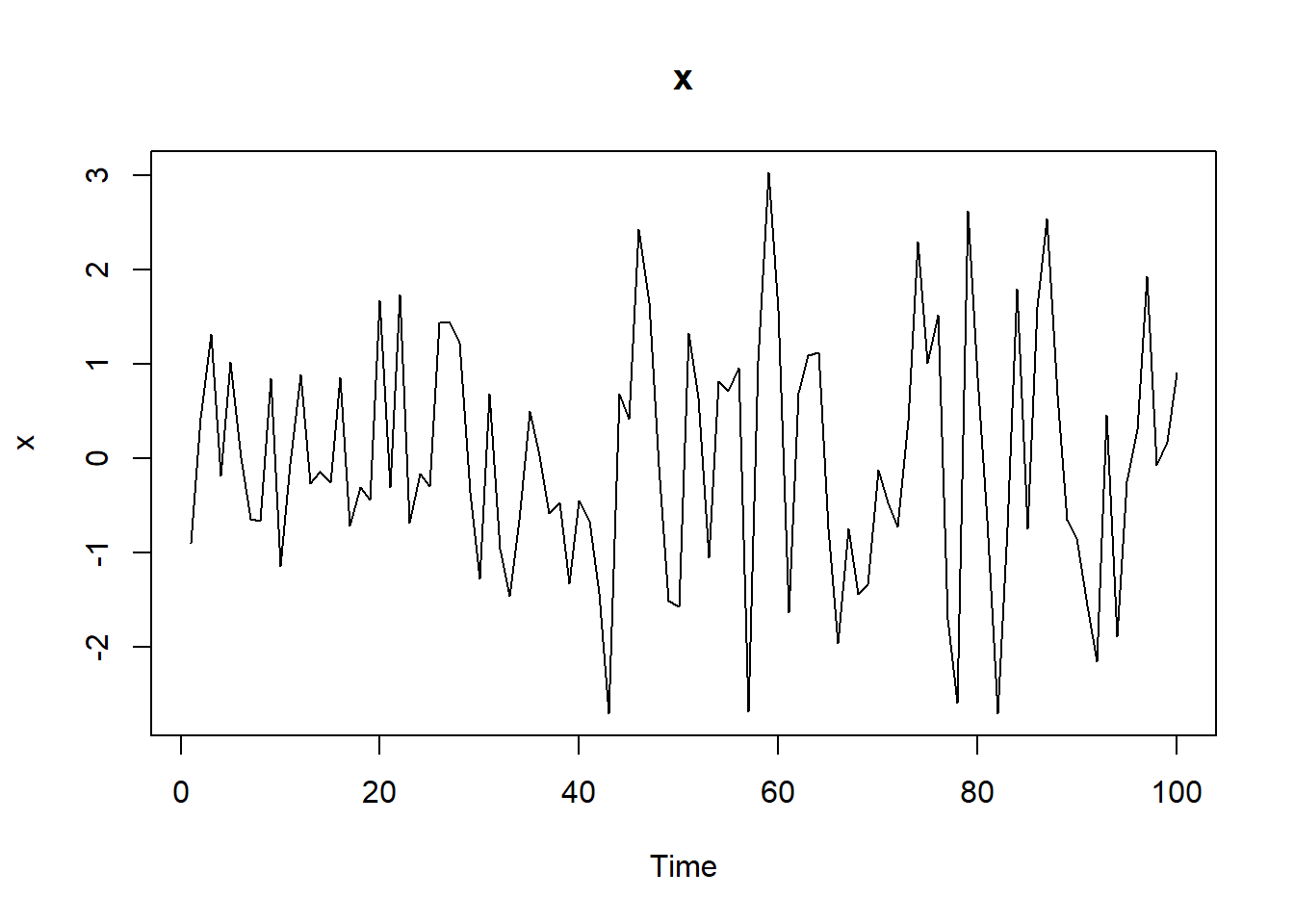

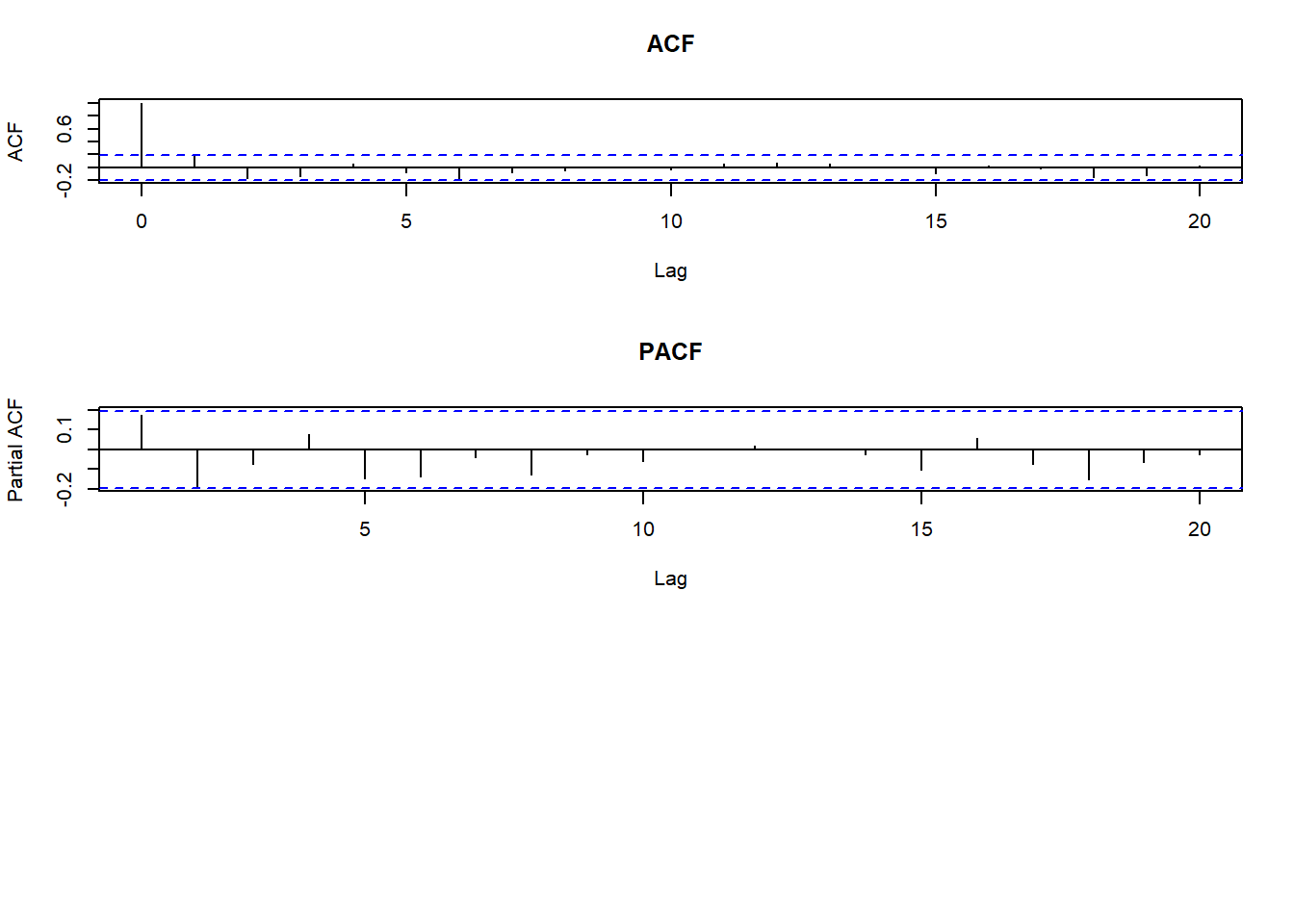

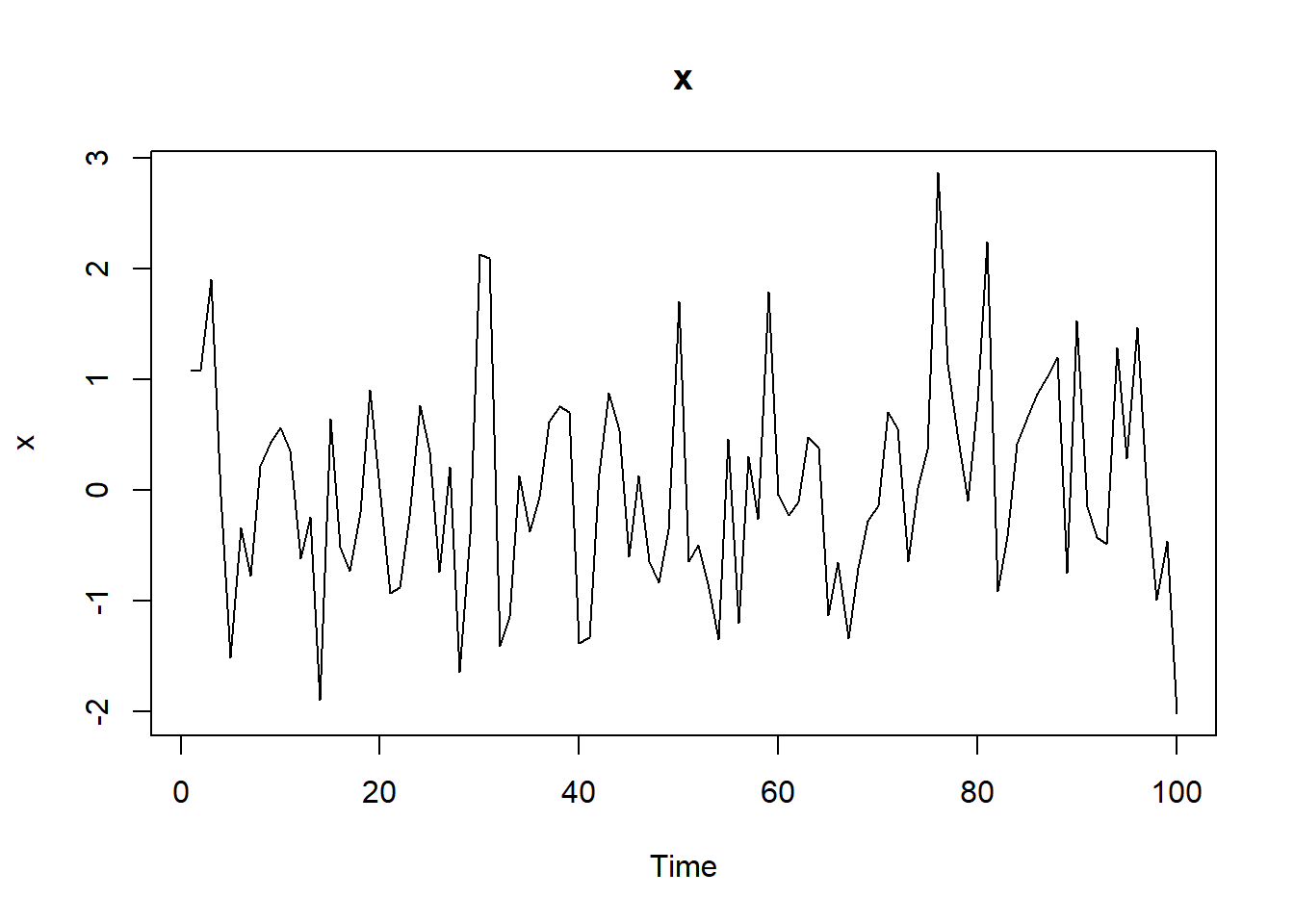

AR(1)생성하기

x<-arima.sim(list(ma=0.2), n=100)

ts.plot(x, main="x")

par(mfrow=c(3,1))

acf(x, main="ACF")

pacf(x, main="PACF")

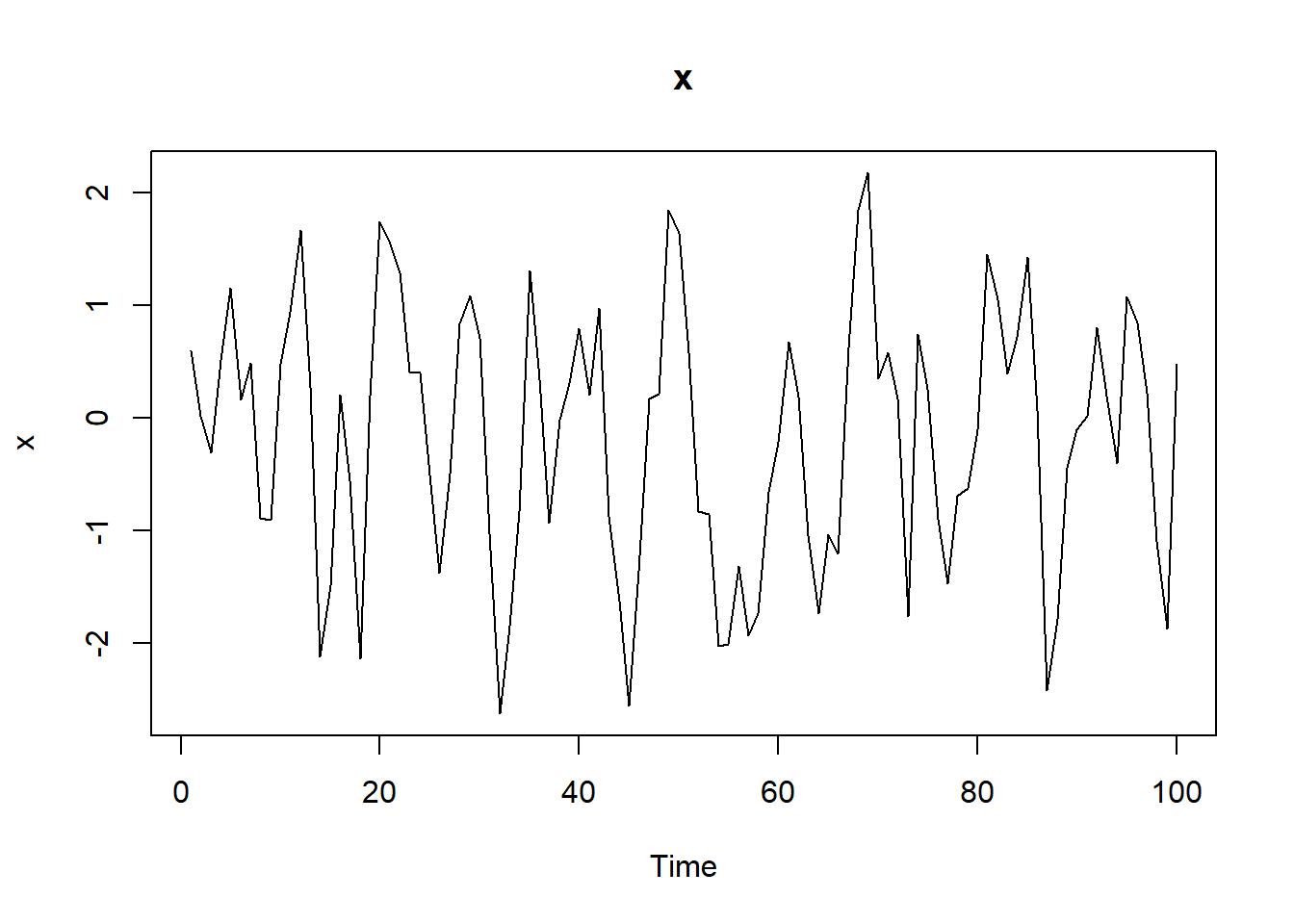

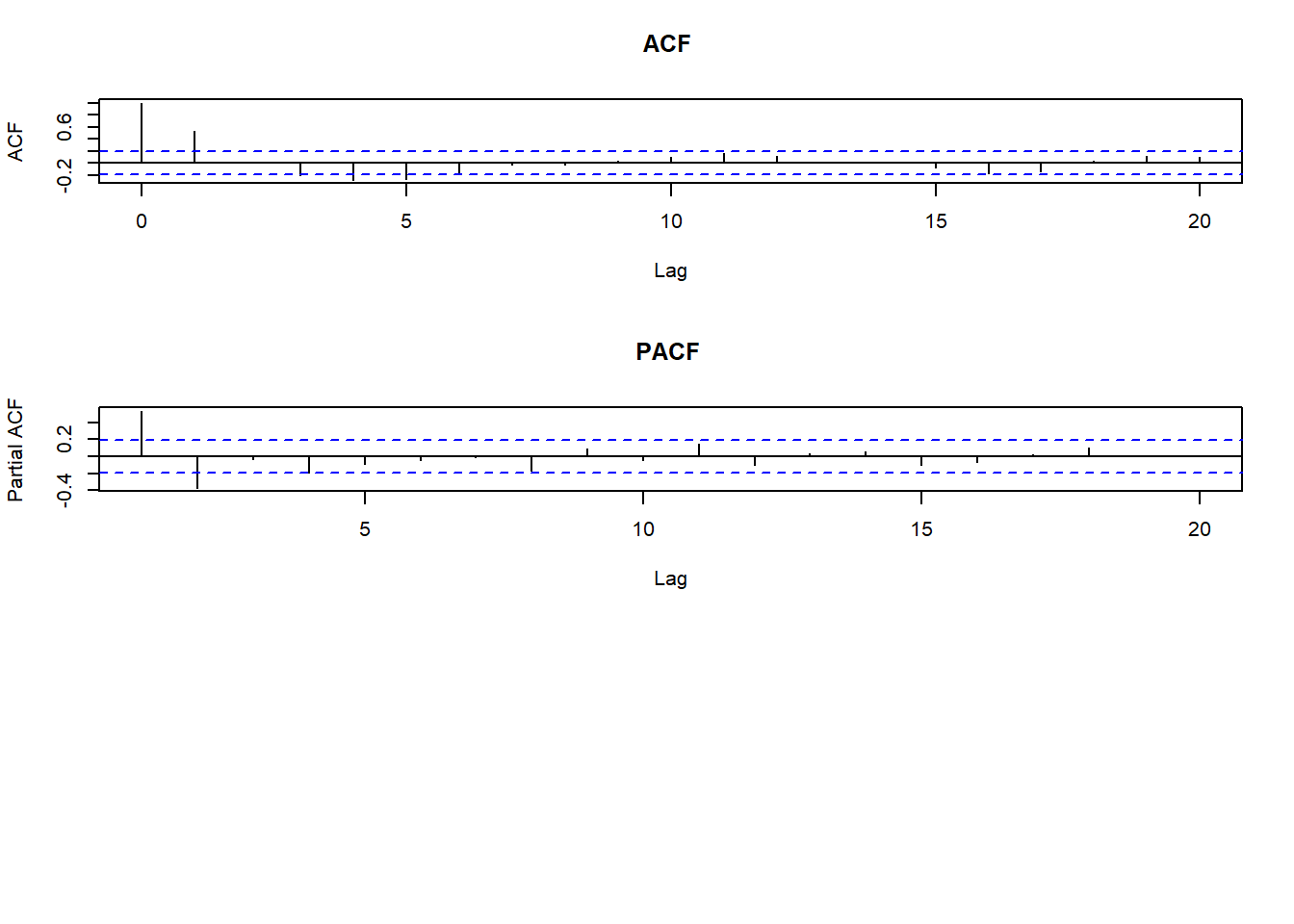

MA(1)생성하기

x<-arima.sim(list(ma=0.8), n=100)

ts.plot(x, main="x")

par(mfrow=c(3,1))

acf(x, main="ACF ")

pacf(x, main="PACF ")

ARMA(1,1)생성하기

x<-arima.sim(list(ar=0.4, ma=-0.3), n=100)

ts.plot(x, main="x")

par(mfrow=c(3,1))

acf(x, main="ACF ")

pacf(x, main="PACF ")

실습

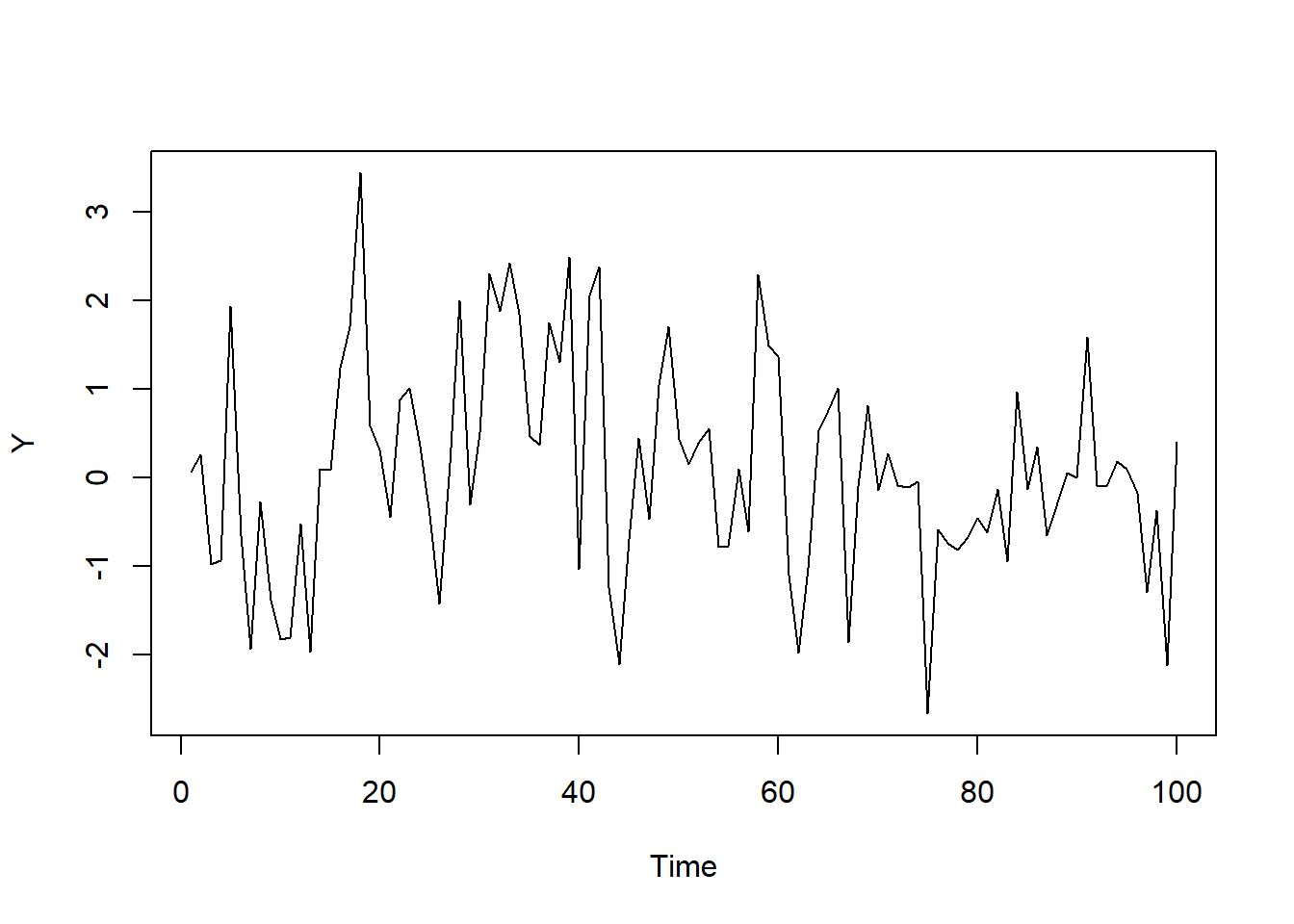

Y<-arima.sim(list(order=c(2,0,0), ar=c(0.3, 0.1)), n=100)모형 식별하기

ts.plot(Y)

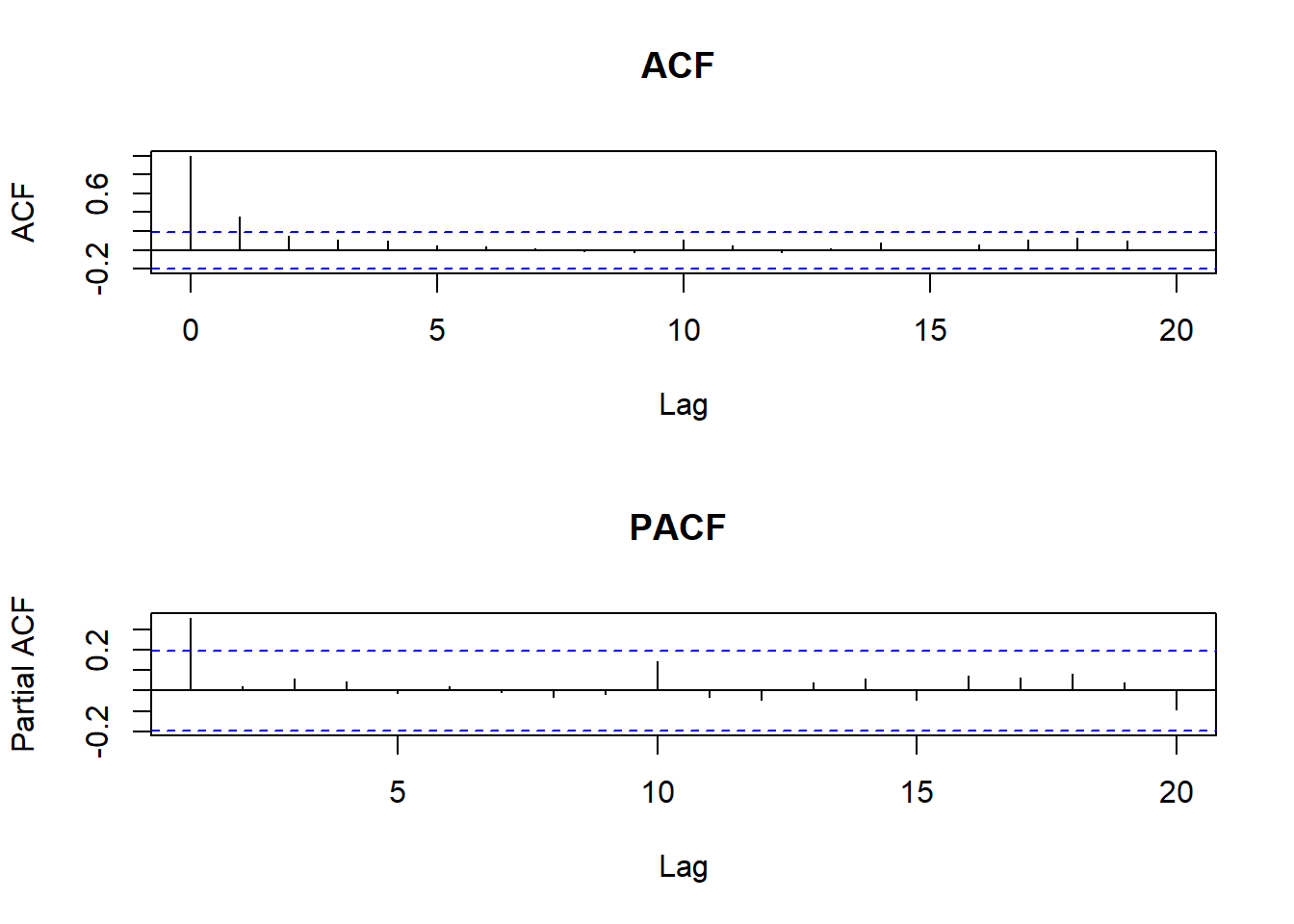

par(mfrow=c(2,1))

acf(Y, main="ACF ")

pacf(Y, main="PACF ") ## 모수 추정해보기

## 모수 추정해보기

TS1 <- arima(Y, c(2, 0, 0))

TS1##

## Call:

## arima(x = Y, order = c(2, 0, 0))

##

## Coefficients:

## ar1 ar2 intercept

## 0.3455 0.0208 0.0928

## s.e. 0.0999 0.1012 0.1756

##

## sigma^2 estimated as 1.253: log likelihood = -153.24, aic = 314.48TS1 <- arima(Y, c(2, 0, 0), method=c("CSS-ML"))

TS1##

## Call:

## arima(x = Y, order = c(2, 0, 0), method = c("CSS-ML"))

##

## Coefficients:

## ar1 ar2 intercept

## 0.3455 0.0208 0.0928

## s.e. 0.0999 0.1012 0.1756

##

## sigma^2 estimated as 1.253: log likelihood = -153.24, aic = 314.48TS1 <- arima(Y, c(2, 0, 0), method=c("ML"))

TS1##

## Call:

## arima(x = Y, order = c(2, 0, 0), method = c("ML"))

##

## Coefficients:

## ar1 ar2 intercept

## 0.3455 0.0208 0.0928

## s.e. 0.0999 0.1012 0.1756

##

## sigma^2 estimated as 1.253: log likelihood = -153.24, aic = 314.48TS1 <- arima(Y, c(2, 0, 0), method=c("CSS"))

TS1##

## Call:

## arima(x = Y, order = c(2, 0, 0), method = c("CSS"))

##

## Coefficients:

## ar1 ar2 intercept

## 0.3490 0.0212 0.0905

## s.e. 0.1005 0.1022 0.1795

##

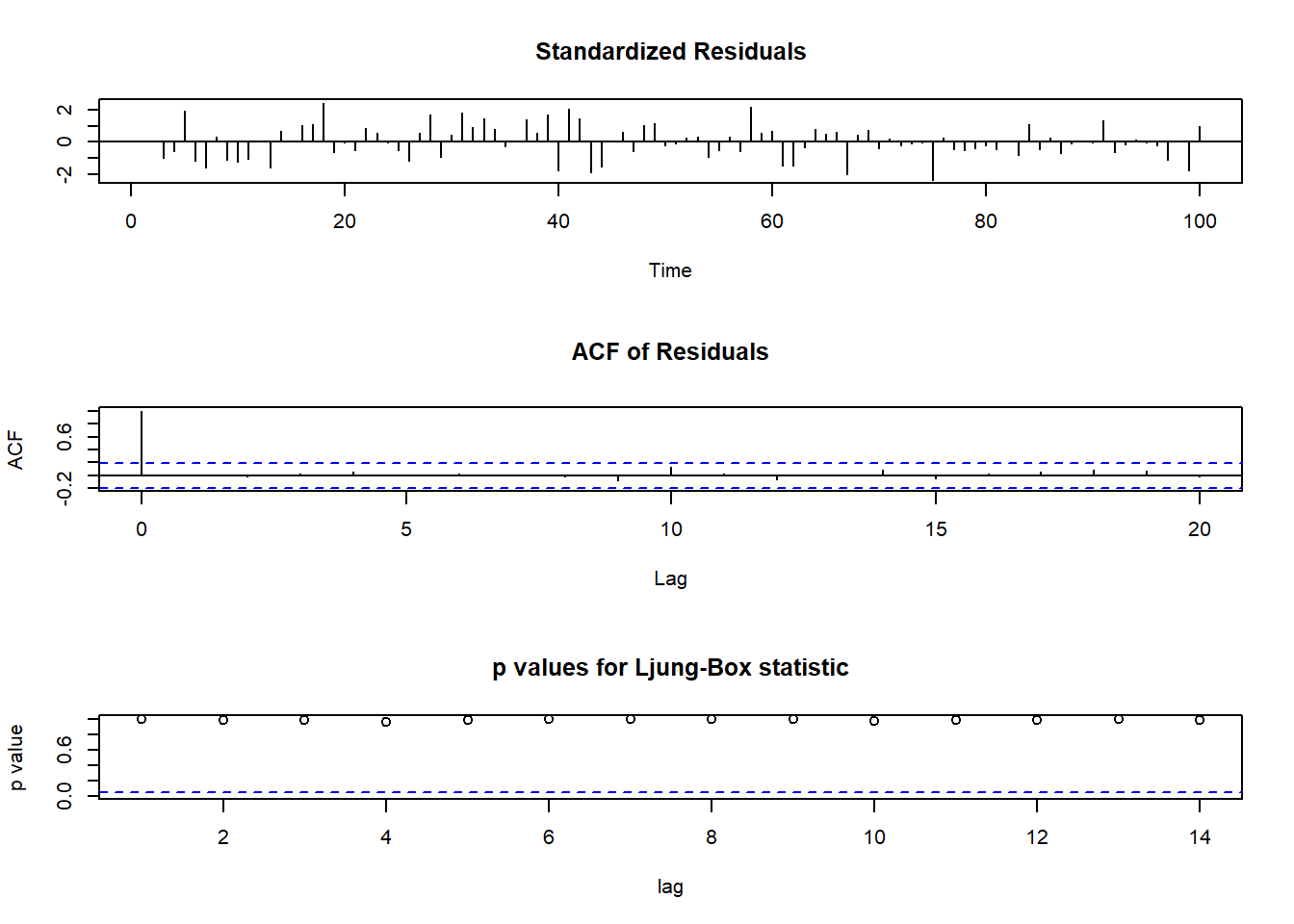

## sigma^2 estimated as 1.278: log likelihood = -154.17, aic = NA모형 진단해보기

tsdiag(TS1, gof.lag=14) ## 모형 예측하기

## 모형 예측하기

future10<-predict(TS1, n.ahead=10)

future10## $pred

## Time Series:

## Start = 101

## End = 110

## Frequency = 1

## [1] 0.15294742 0.11891761 0.10171254 0.09498660 0.09227444 0.09118529

## [7] 0.09074767 0.09057185 0.09050120 0.09047282

##

## $se

## Time Series:

## Start = 101

## End = 110

## Frequency = 1

## [1] 1.130602 1.197460 1.208324 1.210059 1.210339 1.210385 1.210392 1.210393

## [9] 1.210393 1.210393Upper<-future10$pred+future10$se

Lower<-future10$pred-future10$se

Upper## Time Series:

## Start = 101

## End = 110

## Frequency = 1

## [1] 1.283549 1.316378 1.310036 1.305046 1.302614 1.301570 1.301140 1.300965

## [9] 1.300895 1.300866Lower## Time Series:

## Start = 101

## End = 110

## Frequency = 1

## [1] -0.9776541 -1.0785426 -1.1066113 -1.1150728 -1.1180651 -1.1191994

## [7] -1.1196443 -1.1198213 -1.1198922 -1.1199206forecast(TS1,h=10)## Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

## 101 0.15294742 -1.295977 1.601872 -2.062991 2.368886

## 102 0.11891761 -1.415689 1.653525 -2.228061 2.465897

## 103 0.10171254 -1.446817 1.650242 -2.266559 2.469984

## 104 0.09498660 -1.455767 1.645740 -2.276686 2.466659

## 105 0.09227444 -1.458838 1.643387 -2.279947 2.464496

## 106 0.09118529 -1.459985 1.642356 -2.281125 2.463496

## 107 0.09074767 -1.460432 1.641927 -2.281577 2.463072

## 108 0.09057185 -1.460609 1.641753 -2.281755 2.462899

## 109 0.09050120 -1.460680 1.641683 -2.281826 2.462829

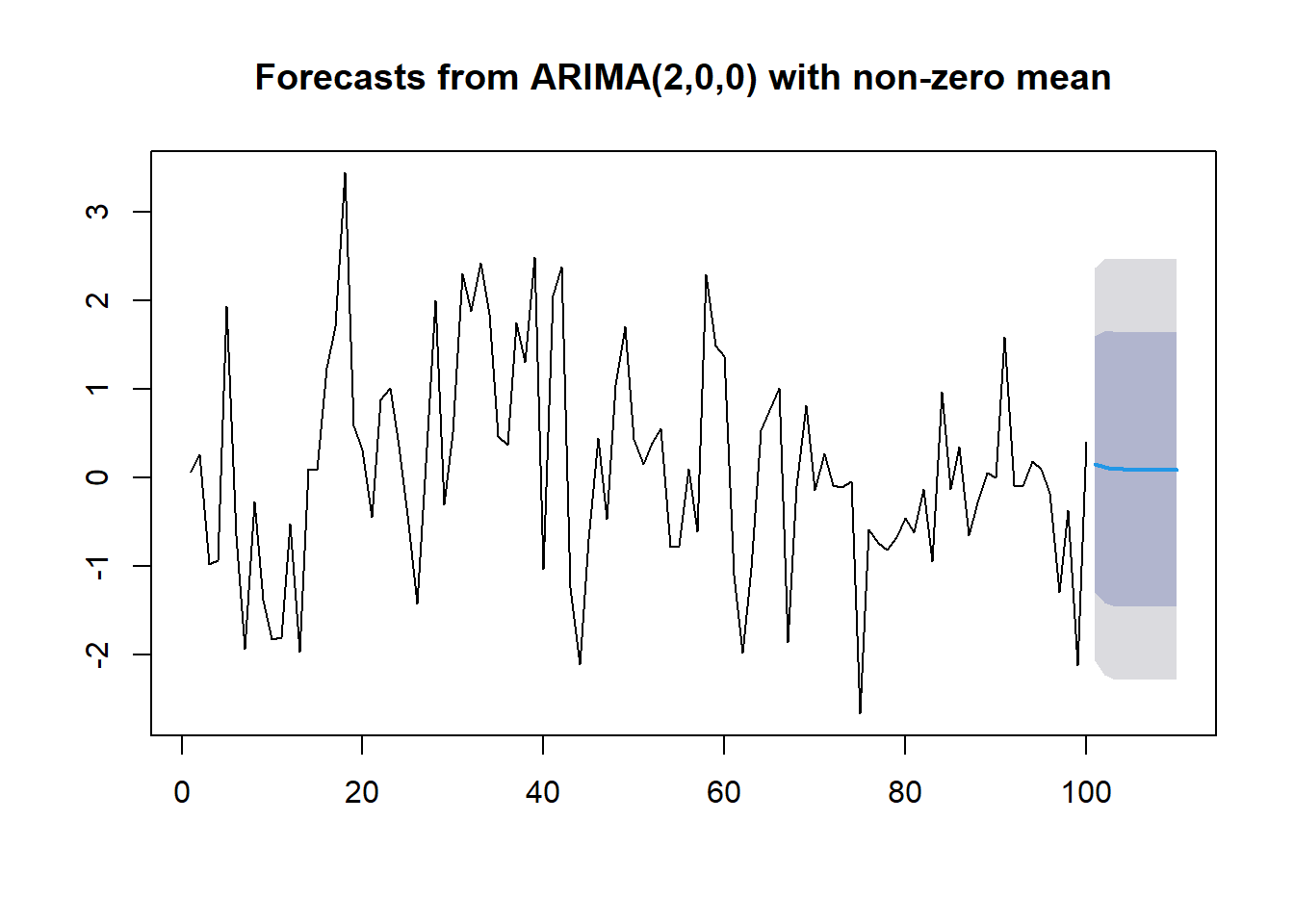

## 110 0.09047282 -1.460709 1.641654 -2.281855 2.462800plot(forecast(TS1,h=10))

차수 식별

auto.arima(Y)## Series: Y

## ARIMA(1,0,0) with zero mean

##

## Coefficients:

## ar1

## 0.3567

## s.e. 0.0927

##

## sigma^2 estimated as 1.27: log likelihood=-153.41

## AIC=310.81 AICc=310.94 BIC=316.02